Insurtech Europe

-

DATABASE (141)

-

ARTICLES (232)

UNIQA Ventures is the venture capital arm of the UNIQA Group, a leading insurance entity headquartered in Austria and operating also across Central and Eastern Europe. With about 40 companies in 18 countries, the UNIQA group serves about 15.5 million customers. UNIQA Ventures' investment focus is in insurtech, fintech and digital health care.

UNIQA Ventures is the venture capital arm of the UNIQA Group, a leading insurance entity headquartered in Austria and operating also across Central and Eastern Europe. With about 40 companies in 18 countries, the UNIQA group serves about 15.5 million customers. UNIQA Ventures' investment focus is in insurtech, fintech and digital health care.

Co-founder, COO of SingularCover

Hoffman is the COO and co-founder of Spanish AI-enhanced insurtech SingularCover, where he has worked since 2018. He previously worked as COO for Spain-based gaming startup Playtomic and in Indonesia as the CEO and founder of e-commerce startup eTailwind, a partner of Lazada Group. Previously, he worked in Indonesia as the Vice-President of Strategy at Alibaba Group and in management positions covering southern Europe for Berlin-based Zalando, Europe’s leading online fashion platform.Hoffman holds a master’s degree from Madrid’s Carlos III University in International Business Management, with exchange program participation in Switzerland and Brazil.

Hoffman is the COO and co-founder of Spanish AI-enhanced insurtech SingularCover, where he has worked since 2018. He previously worked as COO for Spain-based gaming startup Playtomic and in Indonesia as the CEO and founder of e-commerce startup eTailwind, a partner of Lazada Group. Previously, he worked in Indonesia as the Vice-President of Strategy at Alibaba Group and in management positions covering southern Europe for Berlin-based Zalando, Europe’s leading online fashion platform.Hoffman holds a master’s degree from Madrid’s Carlos III University in International Business Management, with exchange program participation in Switzerland and Brazil.

Co-founder, CEO of SingularCover

González-Montejano is the Spanish CEO and co-founder of AI-enhanced insurtech SingularCover, where he has worked since 2018. Prior to this, he briefly worked as CMO at the US-based Center for Cross-Cultural Studies, an exchange program, and at Madrid-based automotive marketplace startup Autingo. He previously spent five years as Senior Vice-President for Southern Europe of Affinion, a global leader in loyalty and engagement solutions and a provider of insurance to large multinationals. Before that, he had spent almost two decades working in the US, the UK, Spain and Southern Europe in a range of executive posts in large multinationals, incuding Citigroup and BNP Paribas. He holds an MBA in Finance from Carroll School of Management, Boston College, and a Business Administration degree from the University of Massachusetts Amherst, as well as a professional qualification as a licensed insurance broker in Spain. González-Montejano volunteers frequently for organizations helping the elderly.

González-Montejano is the Spanish CEO and co-founder of AI-enhanced insurtech SingularCover, where he has worked since 2018. Prior to this, he briefly worked as CMO at the US-based Center for Cross-Cultural Studies, an exchange program, and at Madrid-based automotive marketplace startup Autingo. He previously spent five years as Senior Vice-President for Southern Europe of Affinion, a global leader in loyalty and engagement solutions and a provider of insurance to large multinationals. Before that, he had spent almost two decades working in the US, the UK, Spain and Southern Europe in a range of executive posts in large multinationals, incuding Citigroup and BNP Paribas. He holds an MBA in Finance from Carroll School of Management, Boston College, and a Business Administration degree from the University of Massachusetts Amherst, as well as a professional qualification as a licensed insurance broker in Spain. González-Montejano volunteers frequently for organizations helping the elderly.

Founded in 1997, Seventure Partners is one of Europe’s most prolific VC investors with a portfolio of over 200 startups across both tech and non-tech sectors. The French VC has also managed more than 40 exits in total. It mainly focuses on fintech and insurtech, French and German startups and in life sciences in Europe, North America and Asia.Its five funds cover different market segments, ranging from €24m–€200m, with investments of €500,000–€10m per round. Total funding for a company can reach €20m, right through the early to late stages. Recent investments include the $6.7m Series A round of US biotech Dermala and the $10.7m Series A round of US self-cleaning water bottle startup LARQ.

Founded in 1997, Seventure Partners is one of Europe’s most prolific VC investors with a portfolio of over 200 startups across both tech and non-tech sectors. The French VC has also managed more than 40 exits in total. It mainly focuses on fintech and insurtech, French and German startups and in life sciences in Europe, North America and Asia.Its five funds cover different market segments, ranging from €24m–€200m, with investments of €500,000–€10m per round. Total funding for a company can reach €20m, right through the early to late stages. Recent investments include the $6.7m Series A round of US biotech Dermala and the $10.7m Series A round of US self-cleaning water bottle startup LARQ.

Pioneering insurtech leverages AI to tailor offers to SMEs and the self-employed, with monthly payments and no commission.

Pioneering insurtech leverages AI to tailor offers to SMEs and the self-employed, with monthly payments and no commission.

Indonesia’s first unicorn, Gojek started out providing on-demand app-powered motorcycle taxi services. The company quickly grew as it added more services, making use of its large fleet of riders and eventually branching out into logistics and payments. It has recently made investments in other companies, including Bangladeshi bike-taxi service Pathao, insurtech startup PasarPolis and has acquired payment tech companies Midtrans, Kartuku and Mapan.

Indonesia’s first unicorn, Gojek started out providing on-demand app-powered motorcycle taxi services. The company quickly grew as it added more services, making use of its large fleet of riders and eventually branching out into logistics and payments. It has recently made investments in other companies, including Bangladeshi bike-taxi service Pathao, insurtech startup PasarPolis and has acquired payment tech companies Midtrans, Kartuku and Mapan.

The Airbnb of student accommodation, Uniplaces offers verified housing in-demand cities in six European markets, with over 5 million nights booked to date.

The Airbnb of student accommodation, Uniplaces offers verified housing in-demand cities in six European markets, with over 5 million nights booked to date.

Founded in Moscow in 2021 by Sergey Azatyan who has worked in investment banking since 1999, Inventure Partners currently has nine portfolio companies across diverse market segments in Europe. In March 2019, the VC took a stake in the €5m Series A round of German car-sharing platform MILES Mobility. Inventure joined Refurbed’s $17m Series A round in March 2020 and also in the Series B round in August 2021. Two investees, insurtech Lemonade and medtech Amwell, were listed via IPO in 2020 with Lemonade reported to have achieved the strongest IPO debut in 2020 for a US company. The newly-formed VC has also successfully managed five exits: Busfor, fogg, Getgoing, 2can and Netology. It also partially exited Gett.

Founded in Moscow in 2021 by Sergey Azatyan who has worked in investment banking since 1999, Inventure Partners currently has nine portfolio companies across diverse market segments in Europe. In March 2019, the VC took a stake in the €5m Series A round of German car-sharing platform MILES Mobility. Inventure joined Refurbed’s $17m Series A round in March 2020 and also in the Series B round in August 2021. Two investees, insurtech Lemonade and medtech Amwell, were listed via IPO in 2020 with Lemonade reported to have achieved the strongest IPO debut in 2020 for a US company. The newly-formed VC has also successfully managed five exits: Busfor, fogg, Getgoing, 2can and Netology. It also partially exited Gett.

CEO and Co-founder of Bdeo

Julio Pernía Aznar is a Spanish telecommunication engineer. He started his career as a programmer in CERN and later consulted for big companies like Altran, Telefonica and AENA in a European Commission project. In 2006, he founded his first company, Noaris, specialized in SaaS and cloud computing for insurance companies. He was managing director of Noaris until 2017 when he co-founded Bdeo, a video intelligence platform for underwriting and claims process. Bdeo won the "Most Innovative Product" award in the Insurtech and Fintech categories at the South Summit in Madrid in 2018.

Julio Pernía Aznar is a Spanish telecommunication engineer. He started his career as a programmer in CERN and later consulted for big companies like Altran, Telefonica and AENA in a European Commission project. In 2006, he founded his first company, Noaris, specialized in SaaS and cloud computing for insurance companies. He was managing director of Noaris until 2017 when he co-founded Bdeo, a video intelligence platform for underwriting and claims process. Bdeo won the "Most Innovative Product" award in the Insurtech and Fintech categories at the South Summit in Madrid in 2018.

Portugal’s first online one-stop printing marketplace for SMEs offers high-quality marketing collaterals within 48 hours at low prices in 21 European and American countries.

Portugal’s first online one-stop printing marketplace for SMEs offers high-quality marketing collaterals within 48 hours at low prices in 21 European and American countries.

Founder and CEO of inPlug (inplug.cn)

Aka “China’s first female hardware creator”. One of Huawei’s earliest staff in Eastern Europe/the Balkans (2003-7), opening offices in Hungary and Croatia, Li Qin’s experience of Huawei’s rise in Europe provided fodder for her semi-autobiographical novel, A Thousand Li of Barren Land. A sailing enthusiast. Holds a master’s in Economic Management from Stockholm University (where she studied on a scholarship).

Aka “China’s first female hardware creator”. One of Huawei’s earliest staff in Eastern Europe/the Balkans (2003-7), opening offices in Hungary and Croatia, Li Qin’s experience of Huawei’s rise in Europe provided fodder for her semi-autobiographical novel, A Thousand Li of Barren Land. A sailing enthusiast. Holds a master’s in Economic Management from Stockholm University (where she studied on a scholarship).

Established in New York in 1979, Women's World Banking is a not-for-profit dedicated to financing initiatives for low-income women in developing nations. Its Capital Partners Fund is a private equity limited partnership that makes direct equity investments in women-focused financial institutions.To date, the fund has invested in 12 organizations, mostly banks offering micro-credits, in 10 developing nations. Investments for the first quarter of 2021 included participation in Colombian fintech Aflore’s $6.5m investment round and Kenyan insurtech Pula’s $2m Series A round.

Established in New York in 1979, Women's World Banking is a not-for-profit dedicated to financing initiatives for low-income women in developing nations. Its Capital Partners Fund is a private equity limited partnership that makes direct equity investments in women-focused financial institutions.To date, the fund has invested in 12 organizations, mostly banks offering micro-credits, in 10 developing nations. Investments for the first quarter of 2021 included participation in Colombian fintech Aflore’s $6.5m investment round and Kenyan insurtech Pula’s $2m Series A round.

Founder of Qingqing Jiajiao

Founder and chairman of Shanghai’s biggest education group Only Education. BS Computing, Shanghai Jiao Tong University; Executive MBA, China Europe International Business School.

Founder and chairman of Shanghai’s biggest education group Only Education. BS Computing, Shanghai Jiao Tong University; Executive MBA, China Europe International Business School.

Founder of Fasuper

Shanghai Jiao Tong University graduate who later attended China Europe International Business School, Zhang Yakun has more than 10 years of experience in the auto aftermarket, including in management positions at Michelin and Goodyear.

Shanghai Jiao Tong University graduate who later attended China Europe International Business School, Zhang Yakun has more than 10 years of experience in the auto aftermarket, including in management positions at Michelin and Goodyear.

Founded in 1999, TLCOM Capital now has offices in Kenya, Nigeria and the UK. Originally a global VC investor, its key investment objective now is to tackle Africa’s greatest challenges via its TIDE Africa Fund that was established in 2017.Total funding to date stands at $300m and investments range from $500,000 to $10m. It currently has 12 portfolio companies and has managed 13 exits. Recent investments include the $6m Series A round of Kenyan agro-focused insurtech PULA and the $7.5m Series A round of Nigerian edtech uLesson Education.

Founded in 1999, TLCOM Capital now has offices in Kenya, Nigeria and the UK. Originally a global VC investor, its key investment objective now is to tackle Africa’s greatest challenges via its TIDE Africa Fund that was established in 2017.Total funding to date stands at $300m and investments range from $500,000 to $10m. It currently has 12 portfolio companies and has managed 13 exits. Recent investments include the $6m Series A round of Kenyan agro-focused insurtech PULA and the $7.5m Series A round of Nigerian edtech uLesson Education.

Bdeo: Using video intelligence to automate, speed up insurance claims handling and payouts

Insurtech SaaS Bdeo lets insurers process 70% of motor and property claims without human staff; targets Series A close by year-end

SingularCover: Spanish SME insurance sector disruptor is Virtual South Summit winner

AI-honed personalization is proving successful in the underserved SME insurtech vertical

Cobee: On-demand staff payroll and benefits in an app and card

Backed by Speedinvest, Target Global and Encomenda, Cobee's employee-focused HR SaaS is redefining staff benefits management and beyond

Pula: Pioneering insurtech helps to improve Africa's food security

With Kenyan insurtech Pula’s micro-insurance products, millions of farmers no longer have to bear the full risk of losses from natural disasters and crop failures

HigoSense launching advanced mobile device for self-triage and diagnosis, boosting telemedicine

The Polish medtech has developed a five-in-one diagnostic device for throat, ear, heart checks and more, with diagnosis in four minutes and compatible with diagnostic equipment

Fresh from $13.5m Series A, Indonesian insurtech Qoala takes the long view amid Covid-19

Backed by capital from VCs like Sequoia Capital India, Qoala wants to grow its income channels, team and partnerships as others hold back

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Alpha JWC Ventures bets on Indonesian fintech, analytics startups for big impact

A commitment to mentoring and supporting its portfolio companies also lies at the core of its business

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

After insurtech and fintech, Newralers applies AI to winemaking

Newralers expects strong demand for its disruptive AI solutions that test the cognitive value of information, with clients from listed companies to SMEs

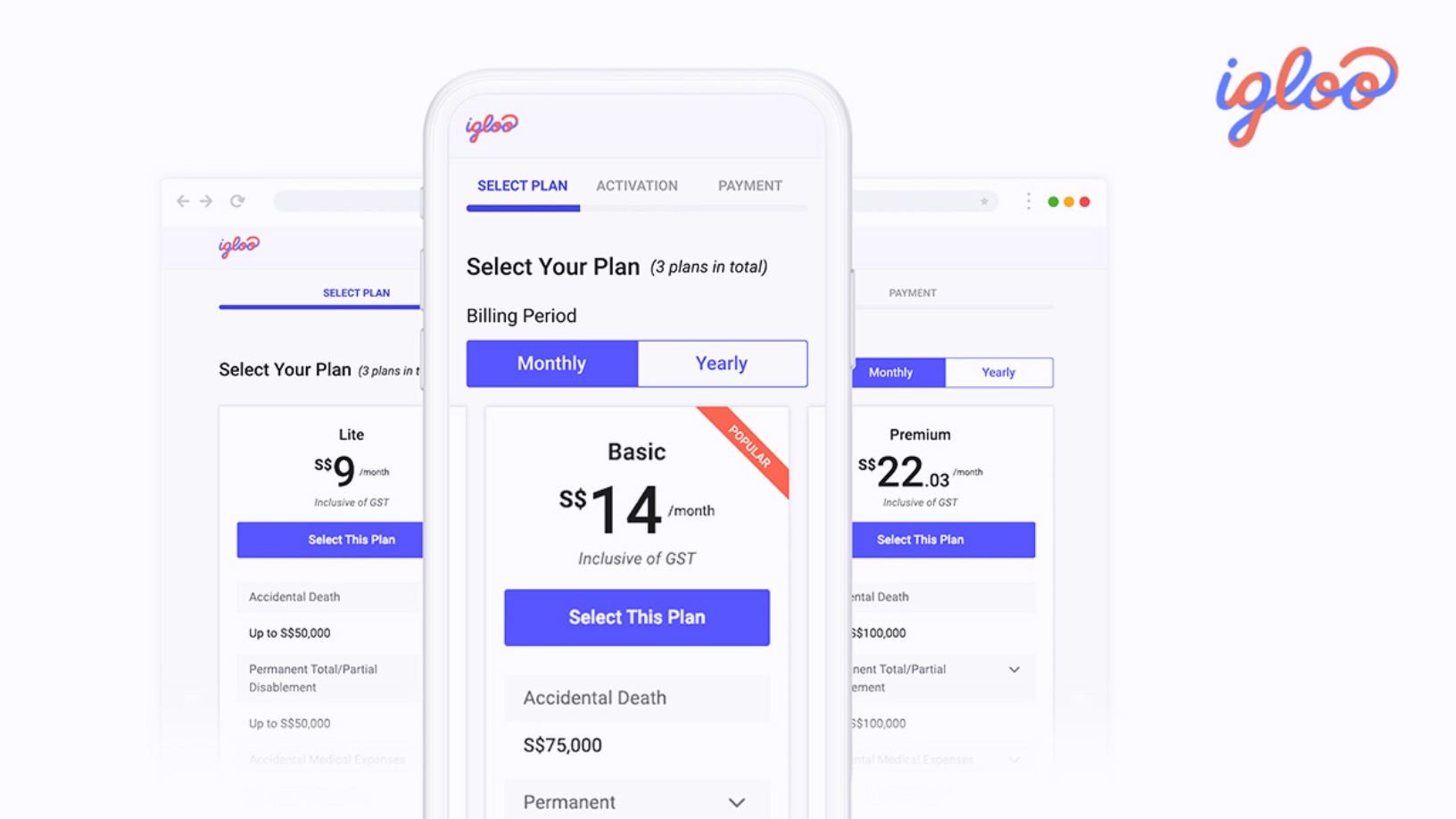

From delivery riders to MSMEs, Igloo aims to make insurance more accessible

Expanding from its origins in e-commerce insurance, Igloo seeks growth in credit insurance and income protection for middle-income groups in Southeast Asia

South Summit 2021: Lessons in expanding to Asia from experts on the ground

Cast aside your Eurocentric mindsets, China-based SOSV’s Oscar Ramos and Brinc’s Heriberto Saldivar tell startups, why they should expand to the region, and how best to do it

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

Backed by pharmas, doctors, medtech startup DyCare is expanding fast across Europe

Its remote musculoskeletal rehabilitation and monitoring system sets to improve rehabilitation outcomes in an overtaxed sector

Europe ramps up development of local EV battery sector in race to zero emissions

Startups, automakers jostle or unite to ride the fast-growing EV battery market, as the EU pumps billions into developing its own value chain, to cut reliance on imports

Sorry, we couldn’t find any matches for“Insurtech Europe”.